Backtest trading strategies in Python

Project description

Backtesting.py

Backtest trading strategies with Python.

Installation

$ pip install backtesting

Usage

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import SMA, GOOG

class SmaCross(Strategy):

def init(self):

Close = self.data.Close

self.ma1 = self.I(SMA, Close, 10)

self.ma2 = self.I(SMA, Close, 20)

def next(self):

if crossover(self.ma1, self.ma2):

self.buy()

elif crossover(self.ma2, self.ma1):

self.sell()

bt = Backtest(GOOG, SmaCross,

cash=10000, commission=.002)

bt.run()

bt.plot()

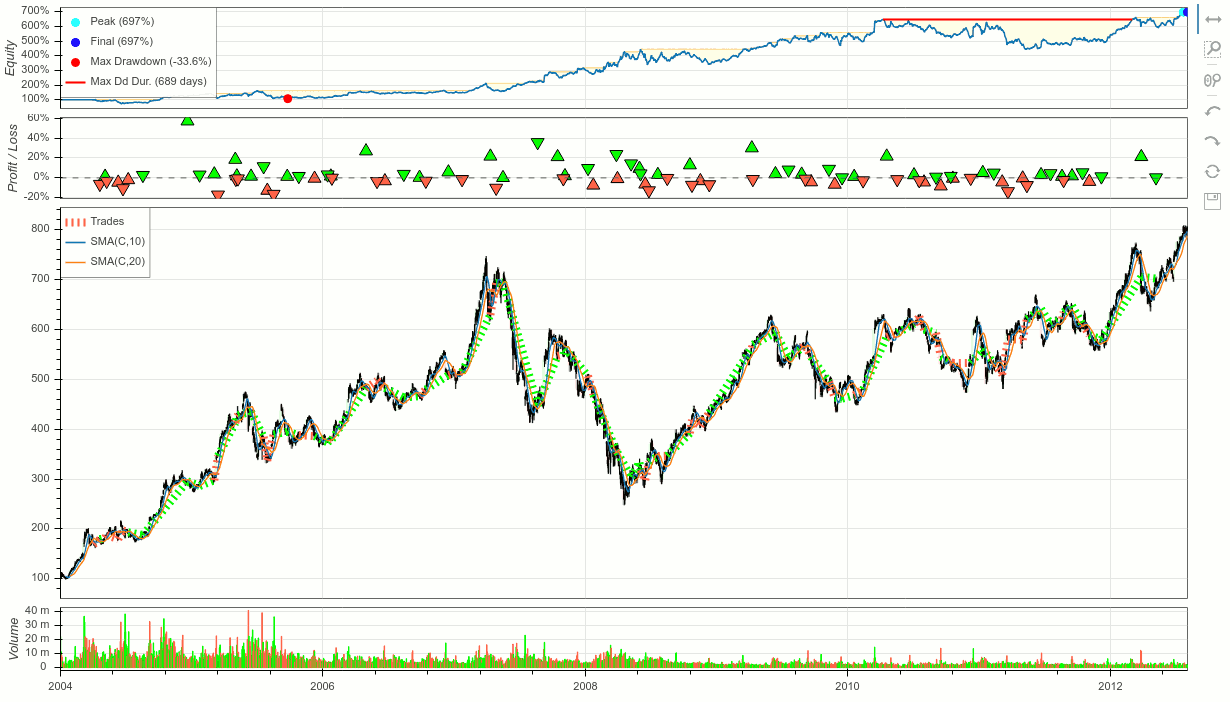

Results in:

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure [%] 94.29

Equity Final [$] 69665.12

Equity Peak [$] 69722.15

Return [%] 596.65

Buy & Hold Return [%] 703.46

Max. Drawdown [%] -33.61

Avg. Drawdown [%] -5.68

Max. Drawdown Duration 689 days 00:00:00

Avg. Drawdown Duration 41 days 00:00:00

# Trades 93

Win Rate [%] 53.76

Best Trade [%] 56.98

Worst Trade [%] -17.03

Avg. Trade [%] 2.44

Max. Trade Duration 121 days 00:00:00

Avg. Trade Duration 32 days 00:00:00

Expectancy [%] 6.92

SQN 1.77

Sharpe Ratio 0.22

Sortino Ratio 0.54

Calmar Ratio 0.07

_strategy SmaCross

Find more usage examples in the documentation.

Features

- Simple, well-documented API

- Blazing fast execution

- Built-in optimizer

- Library of composable base strategies and utilities

- Indicator-library-agnostic

- Supports any financial instrument with candlestick data

- Detailed results

- Interactive visualizations

Project details

Release history Release notifications | RSS feed

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.

Source Distribution

Backtesting-0.1.2.tar.gz

(158.4 kB

view details)

File details

Details for the file Backtesting-0.1.2.tar.gz.

File metadata

- Download URL: Backtesting-0.1.2.tar.gz

- Upload date:

- Size: 158.4 kB

- Tags: Source

- Uploaded using Trusted Publishing? No

- Uploaded via: twine/1.15.0 pkginfo/1.5.0.1 requests/2.22.0 setuptools/41.0.1 requests-toolbelt/0.9.1 tqdm/4.36.1 CPython/3.7.3

File hashes

| Algorithm | Hash digest | |

|---|---|---|

| SHA256 | a49b89fbc4acc861424d9dba5af62583a9ac2cd18bd7ba78894393fd7766c7d2 |

|

| MD5 | 8838e24e9ccf89c891f5aada04e84c0b |

|

| BLAKE2b-256 | cb0878f3cddd05554662737a05a085adaa2aec492272d5cc30cec519b6acde3b |